Getting The Custom Private Equity Asset Managers To Work

Wiki Article

What Does Custom Private Equity Asset Managers Mean?

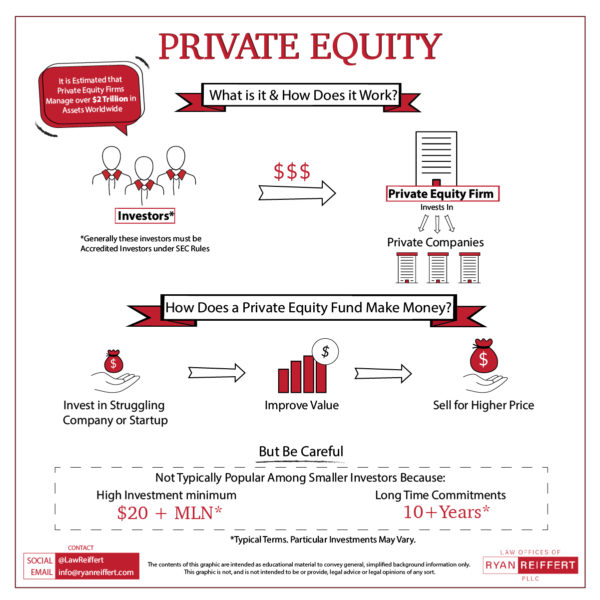

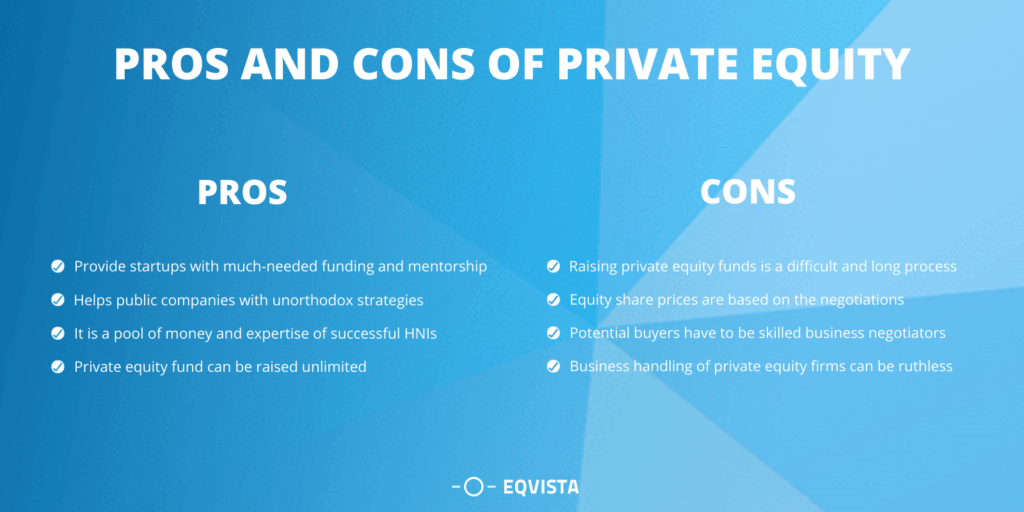

You have actually possibly heard of the term exclusive equity (PE): buying companies that are not openly traded. Roughly $11. 7 trillion in properties were handled by exclusive markets in 2022. PE firms look for possibilities to gain returns that are much better than what can be attained in public equity markets. There may be a few things you don't understand regarding the industry.

Partners at PE firms elevate funds and handle the cash to generate desirable returns for shareholders, typically with an financial investment horizon of in between four and 7 years. Exclusive equity firms have a variety of financial investment choices. Some are rigorous sponsors or easy financiers entirely dependent on monitoring to expand the business and generate returns.

Due to the fact that the most effective gravitate towards the bigger offers, the middle market is a significantly underserved market. There are much more sellers than there are extremely skilled and well-positioned finance specialists with extensive buyer networks and sources to take care of a deal. The returns of personal equity are usually seen after a few years.

Facts About Custom Private Equity Asset Managers Revealed

Traveling below the radar of huge international corporations, a click resources lot of these little firms commonly supply higher-quality customer support and/or particular niche services and products that are not being offered by the big corporations (https://www.nairaland.com/6490712/signal-fastest-growing-app-world/58#127322862). Such benefits draw in the rate of interest of exclusive equity firms, as they possess the understandings and savvy to make use of such possibilities and take the firm to the next level

Private equity capitalists need to have reliable, capable, and reliable management in location. A lot of supervisors at profile firms are offered equity and bonus offer settlement frameworks that reward them for hitting their monetary targets. Such placement of objectives is usually needed before an offer gets done. Exclusive equity chances are frequently out of reach for people that can not invest numerous dollars, but they shouldn't be.

There are guidelines, such as restrictions on the aggregate amount of cash and on the number of non-accredited capitalists (Private Investment Opportunities).

Getting My Custom Private Equity Asset Managers To Work

An additional downside is the lack of liquidity; once in a personal equity transaction, it is not simple to get out of or sell. With funds under monitoring already in the trillions, private equity firms have come to be eye-catching financial investment cars for wealthy people and organizations.

Now that accessibility to personal equity is opening up to even more private financiers, the untapped potential is coming to be a reality. We'll begin with the main disagreements for investing in personal equity: Exactly how and why private equity returns have historically been greater than various other properties on a number of degrees, How including personal equity in a profile influences the risk-return profile, by aiding to expand versus market and cyclical danger, After that, we will describe some essential considerations and risks for exclusive equity capitalists.

When it concerns presenting a new possession into a profile, the a lot of fundamental consideration is the risk-return account of that property. Historically, personal equity has actually displayed returns similar to that of Arising Market Equities and greater than all other conventional asset courses. Its fairly low volatility paired with its high returns produces a compelling risk-return account.

Unknown Facts About Custom Private Equity Asset Managers

Personal equity fund quartiles have the best variety of returns across all different possession courses - as you can see below. Technique: Inner rate of return (IRR) spreads out determined for funds within classic years independently and then balanced out. Typical IRR was determined bytaking the average of the typical IRR for funds within each vintage year.

The result of including private equity right into a portfolio is - as constantly - reliant on the portfolio itself. A Pantheon study from 2015 recommended that consisting of personal equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the very best exclusive equity firms have accessibility to an also larger pool of unidentified opportunities that do not deal with the same examination, as well as the sources to execute due diligence on them and identify which deserve purchasing (TX Trusted Private Equity Company). Investing at the very beginning means greater danger, but also for the companies that do succeed, the fund gain from higher returns

Indicators on Custom Private Equity Asset Managers You Need To Know

Both public and private equity fund managers devote to investing a portion of the fund yet there continues to be a well-trodden problem with straightening passions for public equity fund monitoring: the 'principal-agent problem'. When a capitalist (the 'principal') hires a public fund manager to take control of their resources (as an 'representative') they entrust control to the manager while keeping ownership of the possessions.

When it comes to exclusive equity, the General Companion does not just earn a monitoring charge. They also earn a percentage of the fund's earnings in the type of "bring" (usually 20%). This makes sure that the rate of interests of the supervisor are lined up with those of the financiers. Exclusive equity funds additionally alleviate an additional form of principal-agent problem.

A public equity investor ultimately desires something - for the administration to enhance the supply rate and/or pay out returns. The investor has little to no control over the choice. We showed above just how many private equity approaches - specifically majority buyouts - take control of the operating of the firm, guaranteeing that the long-term worth of the firm precedes, pushing up the roi over the life of the fund.

Report this wiki page